The latest in Tax & Superannuation

- Corporate+

- Sep 12, 2025

- 9 min read

Spring has sprung and we are almost 1 quarter through the 2026 financial year. There are some key changes in tax and superannuation that are set to impact on a range of individuals and business owners this year.

This edition of our newsletter brings together the most relevant information to help you stay up-to-date and make informed financial decisions.

Topics Covered

Interest deductions: risks and opportunities

A win for those carrying student debt

Superannuation rates and thresholds updates

Interest deductions: risks and opportunities

This tax season, we’ve seen a surge in questions about whether interest on a loan can be claimed as a tax deduction. It’s a great question as the way interest expenses are treated can significantly affect your overall tax position. However, the rules aren’t always straightforward. Here’s what you need to know.

The purpose of the loan

The most important thing when looking at the tax treatment of interest expenses is to identify what the borrowed money has been used for. That is, why did you borrow the money?

For interest expenses to be deductible you generally need to show that the borrowed funds have been used for business or other income producing purposes. The security used for the loan isn’t relevant in determining the tax treatment.

Let’s take a very simple scenario where Harry borrows money to buy a new private residence. The loan is secured against an existing rental property. As the borrowed money is used to acquire a private asset the interest won’t be deductible, even though the loan is secured against an income producing asset.

Redraw v offset accounts

While the economic impact of these arrangements might seem somewhat similar, they are treated very differently under the tax system. This is an area to be especially careful with.

If you have an existing loan account arrangement, you’ve paid off some of the loan balance and you then use a redraw facility to access those funds again, this is treated as a new borrowing. We then follow the golden rule to determine the tax treatment. That is, what have the redrawn funds been used for?

An offset account is different because money sitting in an offset account is basically treated much like your personal savings. If you withdraw money from an offset account, you aren’t borrowing money, even if this leads to a higher interest charge on a linked loan account. As a result, you need to look back at what the original loan was used for.

Let’s compare two scenarios that might seem similar from an economic perspective:

Example 1: Lara’s redraw facility

Lara borrowed some money five years ago to acquire her main residence. She has made some additional repayments against the loan balance. Lara redraws some of the funds and uses them to acquire some listed shares. Lara now has a mixed purpose loan. Part of the loan balance relates to the main residence and the interest accruing on this portion of the loan isn’t deductible. However, interest accruing on the redrawn amount should typically be deductible where the funds have been used to acquire income producing investments.

Example 2: Peter’s offset account

Peter also borrowed money to acquire a main residence. Rather than making additional repayments against the loan balance, Peter has deposited the funds into an offset account, which reduces the interest accruing on the home loan. Peter subsequently withdraws some of the money from the offset account to acquire listed shares. This increases the amount of interest accruing on the home loan. However, Peter can’t claim any of the interest as a deduction because the loan was used solely to acquire a private residence. Peter simply used his own savings to acquire the shares.

Parking borrowed money in an offset account

We have seen an increase in clients establishing a loan facility with the intention of using the funds for business or investment purposes in the near future. Sometimes clients will withdraw funds from the facility and then leave them sitting in an existing offset account while waiting to acquire an income producing asset. This can cause problems when it comes to claiming interest deductions.

First, even if the offset account is linked to a loan account that has been used for income producing purposes, this won’t normally be sufficient to enable interest expenses incurred on the new loan from being deductible while the funds are sitting in the offset account.

For example, let’s say Duncan has an existing rental property loan which has an offset account attached to it. Duncan takes out a new loan, expecting to use the funds to acquire some shares. While waiting to purchase the shares, he deposits the funds into the offset account, which reduces the interest accruing on the rental property loan. It is unlikely that Duncan will be able to claim a deduction for interest accruing on the new loan because the borrowed funds are not being used to produce income, they are simply being applied to reduce some interest expenses on a different loan.

To make things worse, there is also a risk that parking the funds in an offset account for a period of time might taint the interest on the new loan account into the future, even if money is subsequently withdrawn from the offset account and used to acquire an income producing asset.

For example, even if Duncan subsequently withdraws the funds from the offset account to acquire some listed shares, there is a risk that the ATO won’t allow interest accruing on the second loan from being deductible. The risk would be higher if there were already funds in the offset account when the borrowed funds were deposited into that account or if Duncan had deposited any other funds into the account before the withdrawal was made. This is because we now can’t really trace through and determine the ultimate source of the funds that have been used to acquire the shares.

To do

It’s worth reaching out to us before entering into any new loan arrangements. In this area, mistakes are often difficult to fix after the fact, which can lead to poor tax outcomes. That’s why getting advice from a tax professional before committing to a loan is essential. We can work alongside you and your financial adviser to ensure your loan is structured in a way that makes financial sense and protects your tax position.

A win for those carrying student debt

In support of young Australians and in response to the rising cost of living, the Australian Government has passed legislation to reduce student loan debt by 20% and change the way that loan repayments are determined. This should help students significantly more than the advice from outside of Parliament - cut down on the smashed avo.

20% reduction in student debt

The reduction is expected to benefit more than 3 million Australians and remove over $16 billion in outstanding debt. The 20% reduction will be automatically applied to anyone with the following student loans:

HELP loans (eg, HECS-HELP, FEE-HELP, STARTUP-HELP, SA-HELP, OS-HELP)

VET Student loans

Australian Apprenticeship Support Loans

Student Start-up Loans

Student Financial Supplement Scheme.

The reduction will be based on the loan balance at 1 June 2025, before indexation was applied. Indexation will only apply to the reduced balance. The ATO will apply the reduction automatically on a retrospective basis and will adjust the indexation that is applied. No action is needed from those with a student loan balance and the Government has indicated that you will be notified once the reduction has been applied.

If you had a HELP debt showing on your ATO account on 1 April 2025 but you paid the debt off after 1 June 2025 then the reduction will normally trigger a credit to your HELP account. If you don’t have any other outstanding tax or other debts to the Commonwealth, then the credit should be refunded to you.

The HELP debt estimator is a useful tool to get an idea of the reduction amount, please reach out if you need any help in working out eligibility.

Changes to repayments

The Government has also modified the way that HELP and student loan repayments operate, primarily by increasing the amount that individuals can earn before they need to make repayments.

The minimum repayment threshold for the 2025-26 year is being increased from $56,156 to $67,000. The threshold was $54,435 for the 2024-25 year.

Under the new repayment system an individual will only need to make a compulsory repayment for the 2025-26 year if their income is above $67,000. The repayments will be calculated only against the portion of income that is above $67,000.

Repayments will still be made through the tax system and will typically be determined when tax returns are lodged with the ATO.

For many people the change in the rules will mean they have more disposable income in the short term, but it will take longer to pay off student loans. The main exception to this will be when an individual chooses to make voluntary repayments.

Superannuation rates and thresholds updates

Super guarantee rate now 12%: what it means for employers

From 1 July 2025, the superannuation guarantee (SG) rate officially rose to 12% of ordinary time earnings (OTE). This is the final step in the gradual increase legislated under previous reforms.

What’s changed?

Old rate: 11.5% (up to 30 June 2025)

New rate: 12% (from 1 July 2025)

This increase affects cash flow, payroll accruals and employment contracts, especially where total remuneration includes superannuation.

Employer checklist

Update payroll software: ensure systems are calculating 12% SG correctly from 1 July 2025 pay runs.

Review employment agreements: if contracts are set to inclusive of super, the take-home pay of employees may reduce unless renegotiated or the employer decides to bear the cost of the increased SG rate.

Budget for higher super contributions: consider possible cash flow impacts

Remember that significant penalties can be imposed for late or incorrect SG payments, including loss of deductions, interest and other administration charges.

Personal superannuation contributions

The annual concessional contribution cap will remain at $30,000 for the 2025/2026 financial year. The annual non-concessional contribution (NCC) cap is set at four times the concessional contribution cap meaning it will also remain at $120,000.

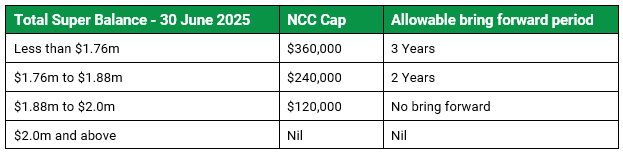

Although the annual NCC cap has not changed, NCCs can now be made by individuals with a total super balance (TSB) of less than $2,000,000 on 30 June 2025 (assuming they have not reached the age 75 deadline and any prior bring forward periods are considered). This is due to the fact that the upper TSB limit links to the general transfer balance cap (TBC) which has increased to $2,000,000.

The relevant TSB amounts for NCCs in the 2025/2026 financial year are summarised in the table below:

Personal deductible contributions

A superannuation fund member may be able to claim a deduction for personal contributions made to their super fund with personal after-tax funds. A member will normally be eligible to claim a deduction if:

The member makes an after-tax contribution to their superannuation fund in the relevant financial year

They are aged under 67 or 67 to 74 and meet a work test or work test exemption

They have provided the superannuation fund with a valid notice of intent to claim

The super fund has provided the member with acknowledgement of the notice of intent to claim.

Notice of intent to claim

If the member is eligible and would like to claim a deduction, then they must notify their super fund that they intend to claim a deduction.

The notice must be valid and in the approved form – Notice of Intent to Claim or vary a deduction for personal super contributions (NAT 71121).

The tax legislation provides a notice of intent to claim will be valid if:

The individual is still a member of the fund

The fund still holds the contribution

It does not include all or part of an amount covered by a previous notice

The fund has not started paying a super income stream using any of the contribution

The contributions in the notice of intent have not been released from the fund that the individual has given notice to under the FHSS scheme

The contributions in the notice of intent don't include FHSSS amounts that have been recontributed to the fund.

What you need to consider

The member must provide the notice of intent to claim to the fund by the earlier of:

The day the individual lodges their income tax return for the relevant financial year; or

30 June of the following financial year in which the individual made the contribution.

However, if a super fund member provides a notice of intent after they have rolled over their entire super interest to another fund, withdrawn the entire super interest (paid it out of super as a lump sum), or commenced a pension with any part of the contribution, the notice will not be valid.

This means the individual will not be able to claim a deduction for the personal contributions made before the rollover or withdrawal.

Updated superannuation and tax thresholds: 2025/2026

Remaining unchanged

The following thresholds will remain unchanged for the 2025/2026 financial year.

If any of the above raises questions for you or your business, please contact our office.

Content written and provided by Knowledge Shop

Comments